I am just now getting back into the flow for the New Year, as I was out of the country until Jan 7th, and was immediately sick for the following week. I meant to do quite a bit of reflection of 2022 and some planning for the year ahead, and finally found a chance to do both.

I'm sharing my 2022 more as an exercise to myself, but also to share what the journey of an entrepreneur looks like (I think it's mostly over-glorified) and share some of my specific learnings. This will likely be one of my lengthier posts.

Context

I've mentioned this before in a previous post, but I'm deeply passionate about helping create economic progress all around the world. I had been searching for opportunities that would do this, but I really didn't come along anything exciting until I I found Crypto.

In 2020, I'm locked at home like the rest of the world and I start watching the A16Z Crypto Startup School series, which really unlocked many ideas in my head. Primarily, I became obsessed with the idea of user-owned networks. What that means is "could the benefits of a networked business mostly accrue to the users who contribute to the network, and not solely to the central entity itself"? Many of the most powerful businesses, especially on the internet based marketplaces, are network based businesses like Airbnb, Uber, Etsy, Amazon, and many more.

As someone who cares deeply about shared economic progress, I would like to see a world in which this value is pushed to the users itself. I am still actively working on this mission, but I can tell you that it's much more difficult than I originally anticipated.

Let's start with January 2022

I officially quit my job in the first week of the year to pursue something I called World Address Book. The basic premise was: could we use smartphones to help map the 50% of the world that lacked addresses and build this on blockchains so that the contributors primarily captured most of the economic value. Though, my higher priority making sure I found a cofounder that matched my ambitions, had the same sense of mission, and had a complimentary set of skills and energy. I even wrote an in-depth personal statement as well as a process I wanted to follow. This bat signal helped me a lot by letting people know what I was about up front.

I pored through my existing network and through a community I had joined, On Deck, taking somewhere around 6-7 calls a day talking to various people to see if there was a match. Long story short, I finally met Tricia, my now cofounder. We followed the process mostly, and it became pretty apparent that it was a good fit and we are still operating together. After meeting up in person, it became pretty apparent to me that I wanted to be the CTO of the business, I enjoy being technical and focusing on the build side of the house. And Tricia has the energy and fight to make a powerful CEO.

This took a few months to actually happen and really feel comfortable about the decision.

April 2022 - Ideas, Ideas, Ideas

Tricia's major focus was on how to provide more ownership to people who work in alternate work forces such as gig workers. This aligned with my obsession with user-owned networks. We went through a systematic approach on how to evaluate ideas, and honestly spent a ton of time reaching out to prospective customers, learning pain points, but mostly learning the flaws in the ideas then going back to the drawing board.

Something that came up over and over again was that all marketplaces face a similar challenge, recruiting and retaining talent! We thought with our mission of ownership and this challenge we could build a loyalty service built on top of crypto rails that would reward supply-side operators in a marketplace with direct ownership over the platform. Here is a short demo of a working prototype that I had built showing you how you could distribute crypto token rewards to your users even if they didn't have a wallet.

In parallel of me building out the product, Tricia kicked off our fundraising process as we were both running on personal funds and realized it was probably a good time to go out in the market and raise some funds. I'm a previous YC founder with years of startup experience, and Tricia was a 2x founder in the FinTech space, so we both felt confident. Additional to that, we realized that to give out ownership we would also need to get better at understanding the regulatory implications of distributing tokens as a centralized marketplace, so I was reading everything I could and talking to as many lawyers as I could before they would charge me :)

May 2022 - Buhbye Free Money

I'm not a markets expert, and I've definitely learned a lot through this year, unfortunately the hard way. Around May 2022, Ethereum had fallen more than 50% from its peak, inflation worries were peaking, and the Fed decided to hike interest rates. We were either already in or heading towards a bear market. This spooked almost every investor because the economic outlook of the future became uncertain, but the era of zero interest rates and unlimited money was over. Not simply from my experience but from other founder friends we discovered that investors were taking much less meetings than they were almost 6 months ago.

This made fundraising impossible, and after collecting a number of angel checks decided to move on and get back to building. Though, we were still just running on personal funds. (Note: I did find out I was going to receive money from an acquisition of startup I was previously at which made things much easier on me.)

July 2022 - Sufficient Decentralization, uh what's that?

Building product and getting customer demand were both going fairly well, we had a good set of early adopters and people using the beta product, but regulatory/legal became the biggest question mark, and inevitably the killer.

Let me explain... distributing ownership of your company is generally considered a really good thing for early contributors and startups because as the business grows in value, so does that person's ownership in it. This is classically how early stage startups incentivize employees with smaller salaries but future upside, it's a win-win for both parties. This is usually a pretty regulated industry by the SEC under Securities Law, and I believe it should be.

There is a conversation in the Crypto Legal world whether tokens are considered Securities. Well, it turns out that the SEC has a pretty well established way to evaluating whether something is a Security known as the Howey Test. I won't get into the nitty gritty, you can read into it yourself. This law is primarily designed to protect consumers from harm, but there are arguments that it also prevents a lot of people from accessing potentially valuable investments and simply makes the rich richer.

Now, in order for a crypto token to not be considered a security the token issuing entity/project must be sufficiently decentralized. To summarize a Web3 project must be decentralized from an economic, technical, and legal perspective. Which often translates to open source software, shared ownership/economic benefit, and a decentralized legal entity.

This meant in order for our token incentives product to work our customers would have to decentralize by open sourcing all of their software, giving away most of their ownership in the business, and reincorporating in a completely different structure. We realized that this became less of a repeatable software business and more of a fully-handholding McKinsey style consulting and implementation. This was both a tall ask of us and our customers who wanted these benefits but were lean teams trying to focus on their core value propositions.

We had to pivot.

Obviously!

We are somewhere into the early August at this point. We realize that because convincing centralized entities to decentralize and THEN use our product was not a viable business plan, the obvious path is to try and sell this solution to already decentralized entities like DAOs. We went back to doing cold/warm outreach to talk to as many active and aspiring DAOs as we could. Unfortunately, we realized a few things:

- There were more people trying to sell to DAOs than their were actual well functioning DAOs. And the ones that were well organized had this solved because this was one of the core functions of their operations. Most commonly known as Tokenomics.

- There were many DAOs that were starting off but they weren't exactly sure how to operate as a DAO. The playbook wasn't exactly clear and regulatory environment wasn't the easiest to navigate.

So... of course this lead us to our next obvious conclusion. If there were more DAO tools than DAOs, and DAOs still didn't have a well known playbook, Casama needed to BE the DAO. By going through the hard learnings of having to actually build a network/community as DAO and the software to go alongside it, we would both be achieving the mission we set out and also learning the very important lessons necessary to teach others the playbook in the future.

But you can't just start a DAO you need something to have people to come together for and that kicked off the next evolution of our journey.

Finding our niche

After going through a painful fundraising experience, our first failed attempt at PMF, and countless hours of conversations we were tired, yet still determined. We decided to spend some in person time together again back in NYC to get some energy back, do some networking, and continue to ideate and explore our new direction.

We would show up every day and work through various concepts over a whiteboard while trying to nail down which niche to tackle first, then network with people we had scheduled some time with, and recap / be humans while having dinner at the end of the day (it's one of the things I miss about being in person, breaking bread with the people you work with everyday). We even spent some time doing an escape room together to get some team juices flowing!

There were two pictures one with my eyes closed, and one with Tricia's arms flapping. I decided to take the personal L and post the one where I'm embarrassing myself :)

![]() Ultimately, we landed on creating a decentralized marketplace for UX research. Everyone knows that crypto has a severe UX problem, it's one of the key things to unlock mass adoption. We knew plenty of builders in the space who we believed would benefit from UX research, and it was a good way to launch a product and learn the details of what it would take to build a decentralized marketplace. We, also, wanted to move fast because there was one more fundraising window coming up before the infamous VC holiday season kicked in.

Ultimately, we landed on creating a decentralized marketplace for UX research. Everyone knows that crypto has a severe UX problem, it's one of the key things to unlock mass adoption. We knew plenty of builders in the space who we believed would benefit from UX research, and it was a good way to launch a product and learn the details of what it would take to build a decentralized marketplace. We, also, wanted to move fast because there was one more fundraising window coming up before the infamous VC holiday season kicked in.

Tricia went immediately towards lining up some customers, and I started building out a prototype that would present UX research opportunities for people to sign up. We got some quick traction of people who wanted to do UX research and we started to feel good about it. At the same time, we were crafting a narrative together on how we could take this to VCs and raise a pre-seed round. (If you want to see the deck we raised, feel free to reach out to me for it).

Dubious three letter acronyms

In October, Tricia, again being the hustler she is, started to line up meetings, getting intros, working on the deck. This time around meetings came quicker. It wasn't like the summer where it was very quiet from VCs. We started to get some traction with VCs with second, third, fourth meetings. It wasn't as fast as we would have loved, but compared to the summer we were satisfied. And now for those dubious three letter acronyms...

SBF & FTX, I won't pester on this for too long. But, again came another big crypto crash. I'm not a VC so I can't tell you exactly what is in there mind, but I'm certain that a major negative incident in crypto put them back on their heels about how much and where they wanted to invest. Psychologically, I understand it there is a huge blow to the market and it's time to be cautious. We likely also deserve blame for potentially not having a great pitch, narrative, etc. But, it wasn't a winning combo.

We failed to raise again.

Luckily, we had some gracious angel investors who put money into our startup. And we were making money with our UX research product, and I was able to ship software on a weekly basis. All wasn't too bad.

Today

It's January of 2023, we've got roughly 6 months of runway and some revenue coming in. But, we are starting to realize the pain point of UX research may not be a strong enough one. Of course talking to users is important, but people usually just chat with people in their discords or email their customers that they already know. The pain is very strong for UX researchers, but unfortunately there aren't enough of them in crypto for us to make a sustainable business out of it just yet.

So, again we are at a crossroads of a pivot. This time we've got a 6 month ticking time clock. 2022 was wild ride, I expect 2023 to be an even crazier one. And yet, the only way out is up and forward. Our only option is to be tougher than the obstacles in front of us.

Lessons Learned

- It's a long journey and even if you ALREADY know that it was going to be long journey, it's still a longer journey.

- There is actually a benefit to echo chambers, meaning often times your buyer is someone who is already convinced that they need a solution and it needs to exist. You just have to convince them to get it from you. Same thing with investors, you don't want to pitch an investor who doesn't fundamentally even believe in the market you are operating in, you want an aligned partner who believes in you.

- Network-building is hard, but it might be one of the only moats left in today's business environment. Software is easy to write because everyone just uses open source code. Brands, networks, and physical products (few want to do it, and its a hard skill) are likely the only moats I believe in at this point.

- Something I'm learning right now. Go faster. Most of our ideas will fail, but you need to churn through them and see some level of traction before conceiving of grand plans. We made this mistake, and are likely still making this mistake.

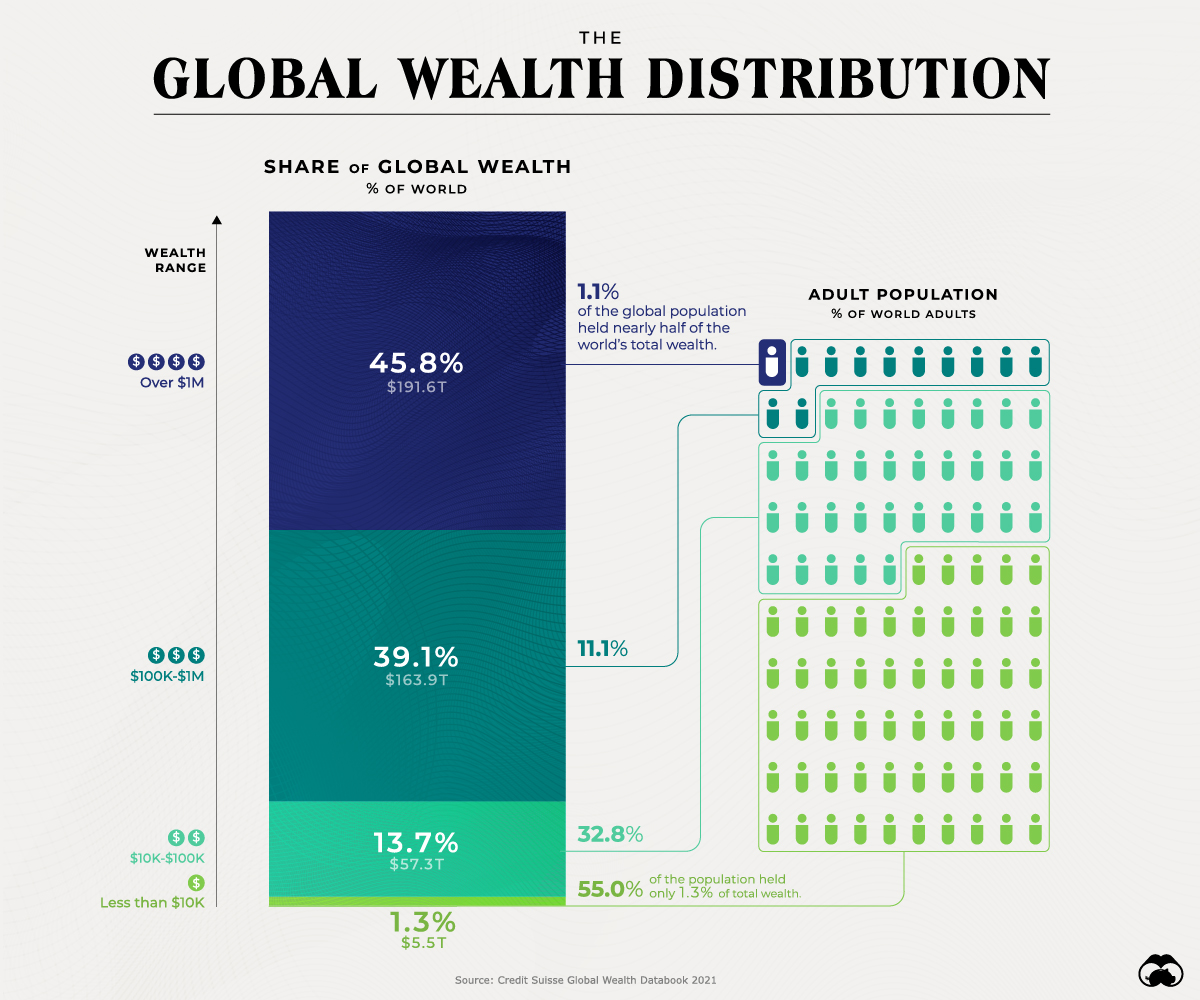

- Outside of many developing nations, the world does not have a free financial system or even a censorship free internet. Capital controls are strong in developing nations because of years of mismanagement leading to short-term solutions. And most countries want to control your information flow to ensure their narrative is still your North Star.

[Seeking safety]

[Seeking safety]