There is likely a lengthier discussion to be had on the role of ownership in our society, but I'll try to convince you of a specific version of the future I hope to see and am actively working on building.

Let's start with the why:

Economic inequity in itself is not the core culprit around the quality of life for most people, absolute poverty and lack of access to basic goods is. Inequity plays out in other sinister ways: 1) it creates a psychological barrier in peoples minds that they can't be happy unless they were higher up the food chain, 2) wealth compounds and if you don't have it you will get left behind, 3) inflation hurts the bottom percentile of wealth holders the most, the same basic goods that were barely accessible are now completely inaccessible now. Inequity is a problem that is less about a specific point in time, but about long-term projections of where ones future may lie if current trends hold.

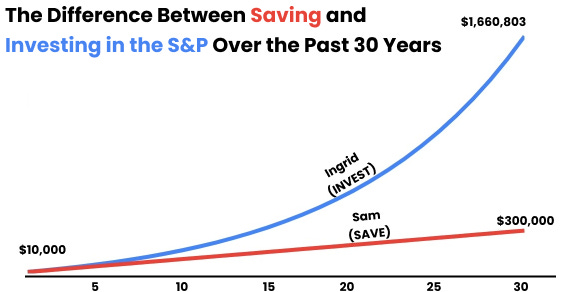

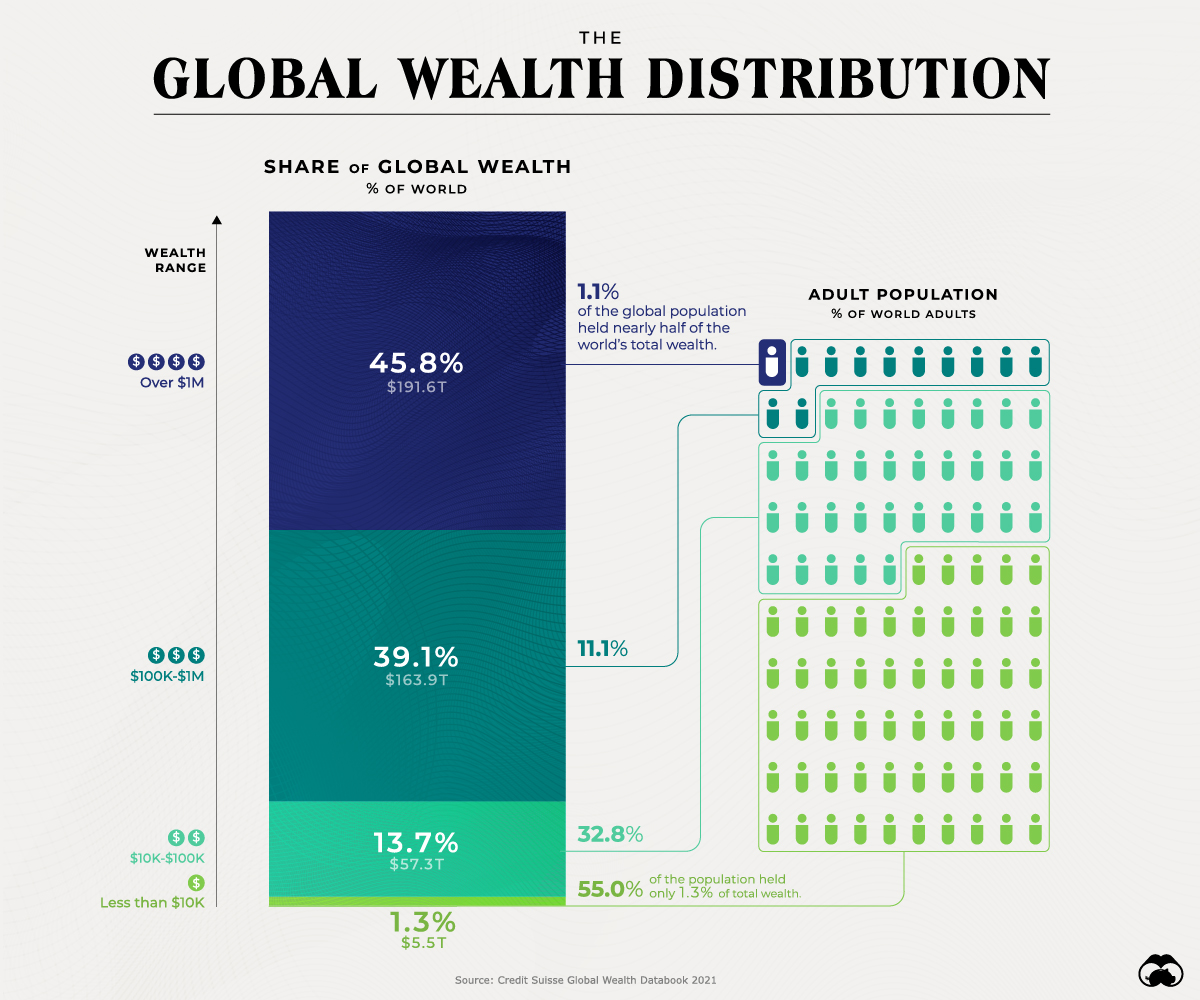

Wealth is not a zero-sum metric, else we would all still be fighting over the same stone-based hammers and wood huts. New wealth is constantly generated, and yes sometimes destroyed, the challenge is where that wealth gets distributed. Most people get wealth distributed to them through wages and salaries, and this wealth is then spent on basic necessities, life expenses, comfort goods, and luxury items which gets distributed again through wages and salaries and the cycle goes on. BUT, there are a few who earn their wealth differently, these are your land owners, equity holders, investors, bond purchasers, and so on. They get their wealth in the form of ownership, which turns out to be better at wealth preservation than wages and salaries. Take a look at an oft-told story about wealth preservation and growth:

(Credit: https://www.notboring.co/p/ownership-and-the-american-dream)

Okay, let's simplify. Wealth is distributed on a spectrum of wages, salaries, and various forms of ownership. Wealth is preserved through cash savings and ownership of assets. But, history has clearly shown us that assets hold their value much better than cash savings.

Let's take a look at the two most well known assets most people hold: stocks and homes. Roughly, 44% of US residents do not own any form of stock and about 35% don't own a home. And often the distribution of how much each person owns is very concentrated as shown below:

Yes, we can make many arguments as to why this is the case. I believe there are three key components that have resulted in this situation: historical, structural, and educational; yet, only two of these are properly actionable. Again, let's do a quick break down of each.

Historical: For generations specific people were not even allowed to own anything. Women were not allowed to own property in various civilizations, and white women have only been able to really own property in the US over the last 100 or so years. People of color have had an even shorter time frame to accumulate wealth in Western nations (where most wealth is concentrated).

Structural: There are legitimate barriers that prevent easy distribution of wealth. Ownership is often accounted in paper documents in a legal registry somewhere and has to get updated through an expensive process through lawyers. Some asset types aren't even available to specific people unless they can prove they already ARE RICH?!

Educational: There is some level of agency we must give to the individual around their understanding of the world around them, but also we can blame an educational system that does not prioritize this information. Many people are not educated on how wealth is preserved and grown by the rich and very rich throughout the world and how this educational gap results in a missed opportunity for them. For most people in developing countries, wealth is primarily preserved in cash savings (which has proven to actually LOSE value due to inflation) and real estate/land.

Is there a way out of this?

I'm an entrepreneur, not a politician, so I can't in my position build scalable solutions for reparations. It is also a very divisive topic and I lean towards bringing people together. But, we can restructure society to make distribution of wealth easier and educate people on why they should own more assets and how.

I will pose more questions for you to think about before I try and attempt an answer in Part 2:

1. Is it even possible to manage distribution of ownership to billions of people, doesn't that get really complicated?

2. Does ownership create entitlement to various perks that rich people have? Do I get to have a voice in the direction of what I own? Do I WANT to have a voice over this or just financial upside?

3. How easy is it for me to exchange one form of ownership versus a different kind?

4. What can even be owned?

5. Financial literacy is at the root of this issue, what are the building blocks for people to understand wealth generation/preservation? But, also how is this drastically changing in the century ahead?

Obvious challenge

If you can't make enough money to meet your basic needs, then obviously you can't save your capital for long-term thinking. This is the right of the privileged, but we must also fight for more people to get ownership in conjunction to their wages... not in replacement of it.

I'm actively working on solving this problem as the CTO of a company called Casama, if you'd love to learn more... feel free to reach out!

Appendix:

https://news.gallup.com/poll/266807/percentage-americans-owns-stock.aspx

https://www.theguardian.com/money/us-money-blog/2014/aug/11/women-rights-money-timeline-history